Did you receive your Property Valuation Notice and are you ready for what’s coming next? Increased property values may result in a significant INCREASE in your monthly mortgage payment!

The 2023 Property Valuation Notice has raised concerns about increased property valuations across the metro area. This is due to a strong economy, influx of people, high demand, and low housing supply over the past several years. As a result, higher property taxes and mortgage payments are expected in 2024. The government is working on a proposal to address this issue, but homeowners can take action now by checking for errors and appealing their property valuation by June 8th, 2023.

Key Points:

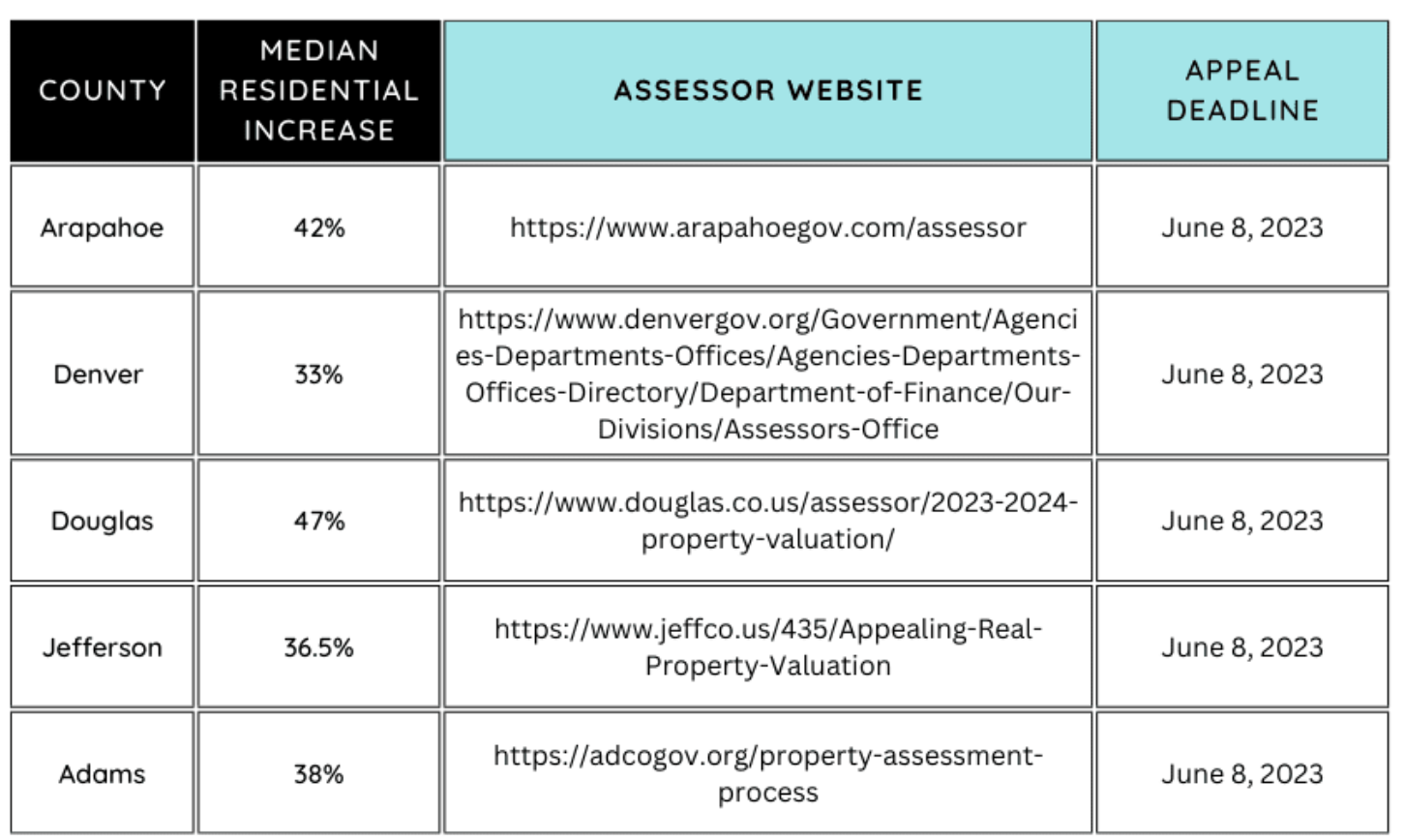

- Property valuations have increased on average by 30%-50% across the metro area

- Increased property values are slated to result in higher property taxes and mortgage payments in 2024

- The government is working on a proposal to address the skyrocketing tax increases (but this may be months away)

- Homeowners can:

o Check their Valuation Notice for errors

o Appeal their property valuation with valid comparable properties

How did we get here?

Here, meaning average increased property valuations ranging from 30%-50% across the metro area and varying county by county. In the past several years, the strong economy, influx of industry and newcomers to Colorado, high buyer demand and low inventory supply have pushed home prices up and, as a result, property values have appreciated tremendously as well.

“We understand what a significant percentage change some of our homeowners and business owners may face in value. We do not know yet what property taxes will be and while we work hard to do a thorough assessment, we want property owners to take a close look at what they receive and tell us if they believe we haven’t gotten their value right.” City and County of Denver Assessor Keith Erffmeyer

What does this mean?

Essentially, it means everyone’s 2024 property tax assessments are going to increase, and increase significantly due to the skyrocketing property values. If you pay your property taxes as part of your monthly mortgage payment, it also means monthly mortgage payments are going to go up in 2024. By law, all properties in Colorado are appraised every other year in order to determine their property tax assessments the following year; the appraised values for this assessment cycle are based on comparable properties which sold between January 1, 2021 and June 30, 2022. One thing to note – these property valuations have no bearing on current market value because they are based on comparable sales that are older than those used to determine current market value.

What might be done about it?

The good news is that the Governor, the Counties, and the State Legislature are working to alleviate the extreme tax increases and they hope to have a proposal on the November ballot. However, there are things homeowners can do now to try and lower their tax burdens before the assessments are levied in 2024.

Image credit: https://www.douglas.co.us/assessor/2023-2024-property-valuation/

LOOK FOR ERRORS IN YOUR PROPERTY VALUATION NOTICE

First, look closely at your Valuation Notice for any errors. Go online and check the comps that were used in the appraisal. They may or may not be actual valid comps; I looked at the property valuation for my own home and found two errors. Furthermore, the county does not always know about the specific finishes in one property compared to another, or whether or not a basement has been finished and therefore should or should not count in the appraised value. If you determine that the comps used are not accurate, you can then find your own comps that may more closely match your property.

APPEAL YOUR PROPERTY VALUATION

Secondly, if you believe your property valuation is inaccurate, you have the option to appeal. Your Property Valuation Notice should provide instructions on how to file an appeal, and you can also locate these instructions on your local county website. Keep in mind that there is a deadline to appeal, and you will need to provide comps to support your appeal and the lower valuation you are hoping to substantiate.

GET HELP

If you are shocked, frustrated, and/or concerned about your property valuation, I am happy to help you. Reach out to me via the “Contact Me” tab on my website, Ryanwilsonhomes.com, and I will gladly evaluate your property valuation with you.

BOTTOM LINE

The increase in property valuations has caught many homeowners off-guard, but there are steps you can take to try and lower your tax burden. By looking for errors in your Valuation Notice, appealing your property valuation, and seeking help from a real estate professional, you can potentially reduce your property tax assessment and save yourself money in the long run.

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link